Don’t Skip These 7 Repairs After Your Home Inspection

You just got your home inspection report, and it’s probably longer than you expected. Pages of findings, notes, and maybe even a few things that sound worse than they really are. If your first reaction was, “Should I be worried?” or “Is the seller going to fix all this?” — you’re not overthinking. These are valid concerns. Thinking about buying new construction instead? Make sure you check out these 10 must-know tips before buying a new construction home so you’re not caught off guard later.

But here’s the truth: most inspection reports look overwhelming. What really matters isn’t the number of issues — it’s which ones actually affect safety, cost, or long-term value. That’s what you need to focus on.

This is where smart negotiation makes all the difference. Because if you don’t know what to ask for — or you go after the wrong things — you could end up:

- Paying thousands out of pocket for repairs you didn’t budget for

- Losing your leverage in a tight market

- Or pushing too hard and losing the deal altogether

Most buyers make one of two mistakes: they either ask for everything (and get ignored), or they back down completely out of fear. Neither helps. The goal here is to protect your future investment — not to nitpick, not to make the seller mad, and definitely not to settle for a deal that hurts you later.

So what should you ask for?

In the next section, we’ll break down the exact types of repairs you should always consider negotiating — and more importantly, why they matter. But before that, let’s look at how to understand your inspection report and where your real leverage comes from.

Now you:

What was the biggest surprise in your inspection report?

Let me know — I might be able to tell you if it’s something you should push back on.

Understanding the Inspection Report and Your Real Leverage

If this is your first time looking at a home inspection, it probably feels like a list of everything that could possibly go wrong. That’s normal. Inspectors are trained to call out every detail — not just the big stuff. Their job is to document, not decide what’s a dealbreaker.

Your job is to separate the noise from what really matters.

If you’re still early in the process, this first-time home buyer guide with 10 simple steps to buying a house in 2025 can give you a clearer roadmap before and after the inspection phase.

Start by breaking the report into two categories:

- Material defects — safety hazards, code violations, or expensive system failures.

- Minor/cosmetic issues — chipped paint, loose doorknobs, or uneven caulking.

Only the first category gives you strong ground to negotiate. Sellers aren’t usually obligated to fix cosmetic stuff, and if you ask for everything, you risk looking unreasonable.

But here’s where most buyers get it wrong — they don’t understand the timing or market context they’re in.

If you’re still within your inspection contingency window (usually 5–10 days), you have options. You can:

- Request repairs or credits

- Renegotiate the price

- Walk away without losing your deposit

If that window closes, your power drops sharply. So whatever you do, act early — and act with clarity.

Also consider your local market. In a buyer’s market, sellers are more willing to negotiate. In a seller’s market, they may have backup offers lined up — so your requests need to be sharp, justified, and backed by real costs or risk.

Don’t rely on emotion or vague concerns. Back up your ask with inspector notes, photos, and — ideally — a contractor estimate. The more factual and solution-oriented you are, the better chance you have of getting a “yes.”

In short: the inspection report is a tool. If you know how to read it and respond smartly, it can protect your wallet, your safety, and your sanity.

Quick gut check:

Do you know which items in your report fall into “negotiation-worthy” territory?

If not, it might be time to bring in a contractor or real estate pro to help you read between the lines.

7 Smart Repairs You Should Always Negotiate (and Why)

Not every problem in an inspection report is worth fighting over. But some absolutely are — because they can drain your savings, damage the home’s value, or put your safety at risk. The key is knowing which ones fall into that category.

Here are seven high-impact repairs that almost always deserve a second look — and why you should consider negotiating them before closing.

1. Roof Issues (Leaks, Damaged Shingles, or End-of-Life Materials)

A bad roof isn’t just expensive — it’s one of the most common reasons deals fall apart after inspection. If your report shows active leaks, rotting fascia, or signs the roof is near the end of its life, you should speak up. A full roof replacement can cost $8,000–$20,000, and most lenders won’t approve a loan if the roof won’t last.

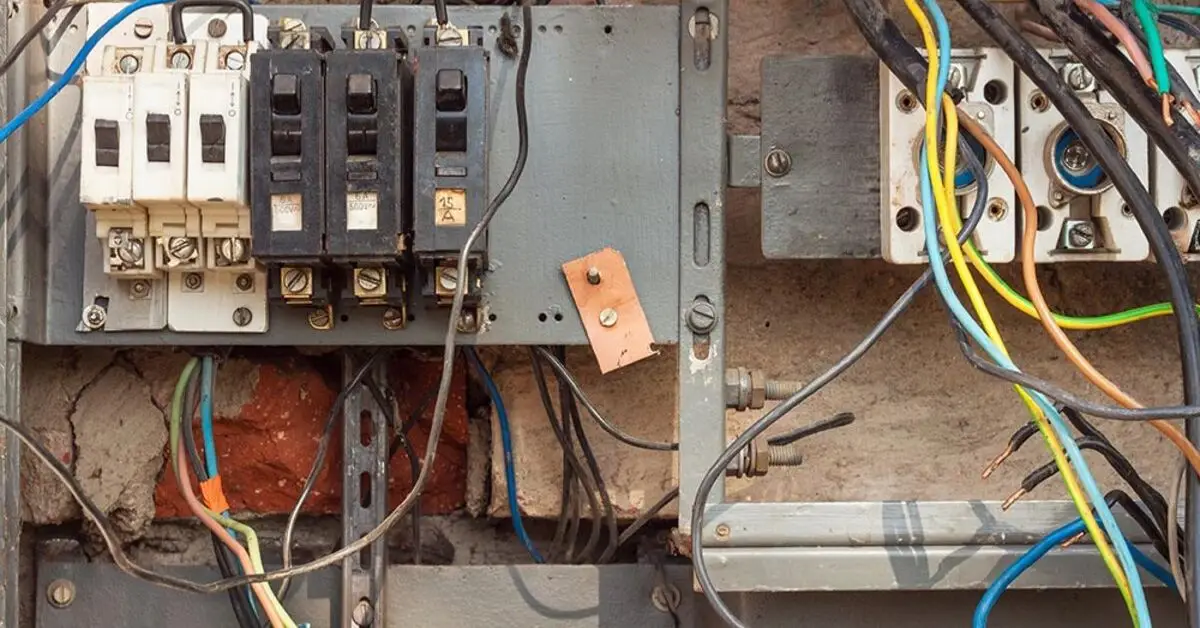

2. Electrical Hazards (Old Wiring, Panels, Exposed Wires)

Electrical systems may not be visible, but they’re a huge liability. If your inspector flags outdated wiring (like knob-and-tube or aluminum), overloaded panels, or visible sparks/exposed wires, treat it as a high-priority issue. These aren’t cosmetic — they’re fire risks.

You don’t want to move in and find out your insurance won’t cover the home because of known electrical defects. Push for repairs or a credit toward replacement by a licensed electrician.

3. HVAC System Failures (Non-Functioning Heat or Cooling)

If your heating or cooling system doesn’t work — or is more than 15–20 years old — it’s fair to bring it up. HVAC replacements are expensive, and if you live somewhere with extreme temperatures, a broken system can make the home unlivable.

If the system is operational but aging, consider asking for a home warranty or service credit. If it’s broken, a direct replacement request is reasonable.

4. Plumbing Problems (Active Leaks, Rusted Pipes, Bad Water Heater)

Small plumbing issues can turn into major headaches fast. If your inspector finds active leaks, water stains, or rusted supply lines (especially old galvanized pipes), it’s not something to ignore. Water damage spreads quickly — and often leads to mold, rot, or even foundation issues.

Also check the water heater’s age. If it’s more than 10–12 years old or showing signs of failure (like corrosion or inconsistent heating), request a replacement or credit.

These are the types of issues that won’t just cost you — they’ll inconvenience you at the worst possible time, right after you move in.

5. Foundation or Structural Cracks

Hairline cracks? Maybe not a dealbreaker. But horizontal cracks, sloping floors, or signs of settling? Those are serious. These repairs often involve structural engineers, support beams, or even excavation. And they’re not cheap.

If your inspector flags anything structural, don’t guess. Ask for a follow-up by a licensed foundation specialist and use that to justify your request. Most sellers know that foundation issues can derail a deal — so you have leverage here.

6. Mold, Termite, or Pest Infestation

Mold and termites are two of the most feared words in real estate — and for good reason. Neither is visible on a typical walkthrough, and both can lead to long-term, hidden damage.

- Mold above EPA-recommended levels may trigger health issues

- Termite damage can compromise structural integrity

- Rodents often mean unseen damage in insulation, wiring, and ductwork

If any of these are present, negotiate for remediation by licensed professionals, not just a surface-level clean-up. And don’t be afraid to walk away if the seller won’t address them — most buyers would.

7. Windows or Doors That Don’t Close, Seal, or Lock Properly

This sounds minor, but it isn’t. If windows don’t open or seal, or if doors can’t lock, that’s a security issue, not just an inconvenience. It also impacts energy efficiency — especially in colder climates — and can lead to higher utility bills or drafts that damage drywall.

Many older homes have warped frames or windows painted shut. Don’t ignore it just because it’s not flashy. You’ll notice it the second you move in.

Pro Tip: You don’t have to demand full repairs. In many cases, asking for a repair credit or price reduction gives you more control and faster resolution — especially for things like HVAC, plumbing, or windows that you may want to upgrade yourself.

How to Present Your Repair Requests the Smart Way

This part matters more than most people think. Even if your repair requests are totally fair, how you present them can make or break the deal.

If you come in with a laundry list and an aggressive tone, chances are the seller will either get defensive or ignore you entirely. But if you approach it like a business conversation — focused on facts, timing, and solutions — you’re much more likely to get what you want.

Here’s how to do it right.

1. Prioritize, Don’t Pile On

Only ask for repairs that clearly affect safety, habitability, or cost. Avoid minor, cosmetic items — even if they bug you. If your list feels excessive, the seller may assume you’re being difficult and push back on everything.

Think in terms of high-impact items, not perfection.

2. Back Up Every Request with Evidence

The more you can show that your ask is grounded in real problems, not just opinion, the better. That means:

- Quoting the exact line from the inspection report

- Including photos from the inspector’s findings

- Adding a contractor estimate, if available

If you’re asking for a $5,000 roof credit, show that the roof is near failure and replacement is urgent — not just that it looks old.

Example: Repair Pricer lets you convert your inspection into a detailed cost report. Sellers often respond better to numbers than emotions.

3. Focus on Repair Credits Over Seller Fixes

In many cases, it’s smarter to ask for a credit or price reduction rather than demanding that the seller fix something themselves.

Why?

- You control who does the work

- You ensure quality

- You avoid closing delays

This is especially true for HVAC systems, plumbing fixes, or anything cosmetic. Unless it’s urgent or structural, most buyers prefer the flexibility of handling it post-close.

4. Stay Firm — but Respectful

Remember: sellers are people, too. Maybe they’re downsizing. Maybe they’ve already agreed to a price drop. You can still be assertive without being adversarial.

Instead of: “This must be repaired or we’ll walk.”

Try: “Given the safety concerns noted in the inspection, we’re requesting a $3,200 credit to address the electrical panel. Let us know what’s possible.”

It’s not just about what you ask — it’s how you ask it.

What Not to Ask For (And Why These Requests Backfire)

A lot of buyers shoot themselves in the foot during inspection negotiations — not because they’re asking for too much money, but because they’re asking for the wrong things.

When you ask for repairs that don’t really matter, you lose credibility fast. Sellers feel like you’re nitpicking, and suddenly the whole tone of the deal shifts.

Here are some common repair requests that seem harmless, but usually backfire.

1. Cosmetic Flaws or Wear-and-Tear

Don’t ask for things like:

- Scuffed walls or chipped paint

- Worn carpet

- Minor drywall cracks

- Loose cabinet doors or squeaky hinges

These are normal in any lived-in home. Unless you’re buying new construction, expect small imperfections — and plan to handle them yourself.

When buyers start listing cosmetic fixes, sellers tune out. Worse, they may reject valid safety-based requests too, just out of frustration.

According to Rocket Mortgage, cosmetic flaws almost never qualify as reasonable repair requests.

2. Code Updates on Older Homes

You might notice things in the report like lack of GFCI outlets or missing handrails. That doesn’t automatically mean the home is unsafe — it might just be built to older codes.

Unless the issue presents a clear danger, sellers aren’t usually required to bring everything up to modern standards. Asking for full compliance can come across as unrealistic — especially in homes more than 20–30 years old.

Ask yourself: is this truly a safety issue, or just outdated?

3. Upgrades You Were Hoping For Anyway

Some buyers try to sneak in upgrades through the inspection phase. Things like:

- “Replace all kitchen appliances”

- “Install a new water softener”

- “Add a second bathroom vent fan”

If something isn’t broken or flagged as a problem, don’t use the inspection as an excuse to get more than you paid for. Sellers will see through it, and agents will advise them to push back.

Focus on necessary, not nice-to-have.

4. A Long List of Low-Cost Fixes

Even if they’re legit, a laundry list of $50–$100 repairs is still a bad idea. It creates friction. Instead, group small issues into one request or skip them entirely.

For example:

Instead of listing 12 small things, say: “We’d like a $500 general repair credit for minor maintenance items noted in the report.”

It sounds cleaner — and it keeps goodwill alive.

Don’t treat the inspection report like a punch list for a perfect house. Use it as a tool to protect your investment, not to chase cosmetic perfection.

What to Do If the Seller Pushes Back (Or Says No)

So, you’ve made your repair requests. You backed them up with the inspection report, maybe a few estimates, and sent them over professionally. Now what?

Sometimes the seller agrees. But just as often, they’ll counter — or flat-out refuse.

Here’s how to handle it without panicking or giving up more than you should.

1. If the Seller Agrees — Confirm in Writing

First things first: get everything in writing. Whether it’s a repair commitment or a credit at closing, your agent should update the purchase agreement or write an addendum.

Also, get clarity on:

- Who’s doing the repair (licensed contractor vs. handyman)

- When it’ll be completed

- What documentation you’ll receive (like paid invoices or warranties)

Don’t assume anything. The more specific you are, the fewer surprises you’ll face at closing. And once you close the deal, don’t forget to handle these 10 essential things to do immediately after buying your home — before you actually move in.

2. If the Seller Offers a Counter — Evaluate It Like a Business Decision

Let’s say the seller won’t replace the HVAC, but offers a $2,500 credit instead.

Ask yourself:

- Does that cover most of the cost?

- Would I rather choose my own contractor anyway?

- Can I live with it for now and replace it later?

Sometimes a credit is smarter than a repair — because it puts you in control. You get to hire who you want, when you want. No rushed patch jobs to “check the box.”

Make sure the numbers are fair. If the seller’s offer feels too low, counter once — politely — and explain why.

3. If the Seller Says No — Know When to Walk

This is where the inspection contingency comes in.

If the seller refuses to address major issues (like foundation problems, mold, or a roof that won’t last another winter), you’re fully within your rights to walk away — and keep your deposit.

You don’t want to move in and immediately start bleeding money into urgent repairs you flagged early. If you settle for too little now, you’ll feel it for years.

And remember: no house is worth losing sleep over.

4. If the Issues Are Minor — Consider Letting Them Go

On the flip side, if the seller won’t budge on small things — like a loose railing or faded carpet — it might not be worth the battle.

A home purchase is already full of negotiation. Sometimes, letting go of the non-essentials helps you keep momentum (and goodwill) intact.

You’re not giving in — you’re choosing your battles wisely.

You don’t win in inspection by getting everything fixed. You win by walking away from the table knowing you made a smart, informed choice — and didn’t overpay for someone else’s problems.

Bonus Move: Ask for a Repair Credit or Home Warranty Instead

Not every repair has to turn into a standoff. In fact, one of the most overlooked — and underrated — negotiation moves is asking for a repair credit or a home warranty, instead of demanding the seller fix things themselves.

Let’s break down why this works, and when it makes the most sense.

Why Repair Credits Often Work Better Than Repairs

Sellers are usually on a deadline. The last thing they want to do is coordinate contractors, chase down invoices, and delay closing.

That’s why offering them a simpler option — like giving you a credit at closing — is often a win for both sides.

You get:

- Full control over who does the work

- Freedom to upgrade instead of just repair

- No rushed or sloppy fixes just to meet the deadline

They get to walk away clean, without one more thing to manage.

As noted in Investopedia, many buyers prefer credits because they offer flexibility and reduce the risk of rushed or low-quality repairs.

When a Home Warranty Makes Sense

If the home has older — but still functioning — systems like HVAC, water heater, or major appliances, a one-year home warranty can offer peace of mind without dragging the seller into a full replacement debate.

Warranties usually cost $400–$700 and cover:

- Plumbing leaks

- Electrical failures

- Heating and cooling systems

- Some appliances

Sellers often agree to include a warranty just to keep the deal moving — especially if they’re not willing to drop the price.

It’s not a perfect solution, but for moderate-risk systems, it’s better than walking away empty-handed.

When to Use This Strategy

This works best when:

- The repair is non-urgent, but could fail soon

- You’re in a tight market, and don’t want to risk losing the deal

- The seller is pushing back on repairs, but still open to compromise

Think of this move as a pressure valve. It takes the edge off tough negotiations — without forcing you to give up value.

Key takeaway:

Credits and warranties won’t solve everything — but they’re often enough to bridge the gap when both sides are close, but not quite aligned.

How to Make the Final Call Without Regret

At this point, you’ve got the inspection report, you’ve identified the key issues, and you’ve either submitted your repair requests or you’re about to.

Now comes the part that no one can do for you: deciding what’s worth fighting for — and what’s not.

Here’s a simple way to sort it all out, without overthinking or second-guessing yourself.

Ask Yourself These 3 Questions:

- Would I still want this house if none of these repairs were done? If the answer is yes — and the price is still right — you probably don’t need to walk.

- Are these problems urgent, or just annoying? Focus on issues that affect health, safety, or your wallet in the first year. Let go of the rest.

- Is the seller’s response reasonable? Even if they don’t say yes to everything, a fair credit or warranty might be all you need to move forward comfortably.

Use This Quick Decision Table:

| Repair Type | Ask for Fix or Credit? | Dealbreaker? |

|---|---|---|

| Roof leak | Credit or replacement | Yes |

| Mold/termites | Licensed remediation | Yes |

| Cosmetic wall damage | Let it go | No |

| Aging HVAC (but working) | Warranty or credit | Maybe |

| Loose window seals | Ask or ignore | No |

| Exposed wires | Must fix or credit | Yes |

One Final Thought

You’re not trying to get a perfect house. You’re trying to get a fair deal.

The inspection isn’t a test the house has to pass — it’s a tool to help you make a smart, confident decision. Use it that way.

And if the seller won’t meet you halfway on major issues? Don’t be afraid to walk. There will always be another house. There’s only one you.

What about you?

Are you stuck on a repair decision right now? Not sure what’s fair to ask for?

Leave a comment or shoot over the issue — I’ll help you think it through.

Want more smart home buying tips? Visit Build Like New for expert guides, checklists, and advice that helps you buy with confidence — not regrets.

Disclaimer: This article is for informational purposes only and does not constitute legal, financial, or real estate advice. Always consult with a licensed professional before making decisions related to property inspections or negotiations.