Home Invasion in San Francisco Leads to $11 Million Crypto Theft

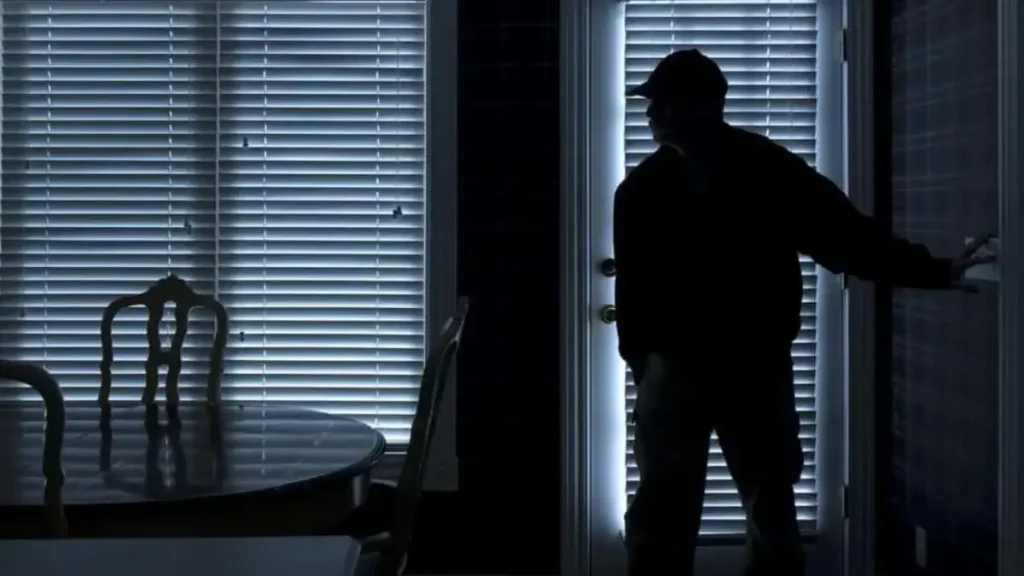

I still can’t get over how brazen this heist was. Imagine a quiet Saturday morning in San Francisco’s Mission Dolores neighborhood, and suddenly a stranger shows up at your door pretending to deliver a package.

That’s exactly what happened to one homeowner last weekend. The intruder wasn’t just a thief — he was armed, tied up the resident with duct tape, and walked away with the victim’s cellphone, laptop, and a staggering $11 million worth of cryptocurrency.

You might be thinking, “$11 million? How does that even happen?” The answer is partly in the tech and partly in human behavior. This wasn’t some digital hack from a hacker in a basement — this was a physical attack, right in someone’s home. And it’s a warning sign: if you’re holding crypto, especially large amounts, your home could suddenly become a target.

What’s striking is how quickly the thief dropped the act of being a delivery worker. One moment, they’re the friendly courier; the next, they’re brandishing a gun. I’ve read the police reports, and while it’s unclear whether the victim was physically injured or if anyone has been arrested, the sheer audacity sends a message: physical threats against crypto holders are real, and they’re rising.

Before we dive into the details, I want you to think about this: How secure would you feel if someone could walk in and access your devices containing your digital wealth? That’s the scenario many crypto investors might be underestimating — and that’s why this story matters, not just as news, but as a wake-up call.

The Heist — Step by Step

I want you to picture this: it’s early Saturday morning, around 6:45 a.m., in San Francisco’s Mission Dolores neighborhood. You’re going about your routine, and suddenly someone knocks at your door claiming they have a delivery for you. That’s how this nightmare began.

According to The New York Post, the thief used the guise of a delivery worker to get inside. Once the door was open, the friendly act vanished. The intruder brandished a gun, tied up the homeowner with duct tape, and made off with a cellphone, a laptop, and a massive $11 million worth of cryptocurrency.

You can’t help but feel how fast this turned from normal morning to absolute chaos. It’s not just about the money — it’s about the violation of your personal space and the shock of realizing someone can target you so directly.

Even smaller-scale burglaries, like the San Fernando Valley home hit, demonstrate that thieves often target everyday households for quick gains.

Rising Threats to Crypto Investors

This isn’t an isolated incident. Over the past year, we’ve seen violent attacks on crypto holders increasing, and the trend is worrying. Just look at some recent cases. In March, influencer Amouranth — whose real name is Kaitlyn Siragusa — had burglars try to steal cryptocurrency from her home.

Then, in May, two men in New York City allegedly kidnapped and tortured an Italian millionaire, Michael Valentino Teofrasto Carturan, for his Bitcoin password. These aren’t small, random crimes; they show a pattern of attackers targeting people who hold digital wealth.

The San Francisco Chronicle reported that this kind of theft is part of a worrying rise in violent kidnappings and robberies aimed at crypto investors. The thing you need to realize is that cryptocurrency is much harder to trace than cash, and once stolen, it can be laundered quickly.

Why this matters: you can’t just secure your devices digitally anymore. If someone knows you hold crypto, your physical safety and your digital security are intertwined. This section helps readers understand that risk isn’t abstract — it’s immediate and real.

High-profile home invasions aren’t limited to crypto targets — incidents like the deadly Kendall home invasion show how quickly things can escalate when intruders are armed.

Understanding the Attacker’s Motivation

Why would someone risk such a violent act? Steve Krystek, CEO of personal security company PFC Safeguards, told The Post, “Kidnappings of crypto investors are definitely on the rise. A lot of the people who come into this money are flashy, and they’re signaling that they have wealth.”

Think about it. Flashy cars, public social media posts, or even just being known as a crypto investor — these signals make someone a target. Criminals are no longer satisfied with online hacks; they want direct access to the devices holding your private keys.

The motivation is simple: crypto is portable, valuable, and hard to trace. For attackers, it’s an efficient high-reward crime. And for you, it’s a warning: your behaviour — even small things like showing off wealth online — can increase your risk.

This section matters because it goes beyond the news headline. It explains why these crimes happen and gives readers the insight to change their habits before becoming a target themselves.

How Crypto Holders Can Protect Themselves?

Here’s where it gets practical. If you hold crypto at home, the first thing you need to do is secure your physical environment. Screen visitors, confirm delivery identities, and install video doorbells. Simple steps can make a big difference.

Next, think about digital security. Hardware wallets or cold storage are your best friends. Never keep your private keys on devices connected to the internet. Encrypt everything, use strong passwords, and enable multi-factor authentication.

Finally, consider behavioural safeguards. Don’t broadcast your wealth. Avoid public posts about holdings. The less visible you are as a crypto holder, the less attractive a target you become.

You can also get real-time updates and tips on incidents like this through channels that track local safety alerts and crypto security discussions.

Legal and Investigative Challenges

Even if the police get involved, recovering stolen cryptocurrency is far from easy. The San Francisco Police Department has not released details about the suspect, and tracing digital assets is extremely complicated once they move through multiple wallets or exchanges.

It’s not just a technical problem. Law enforcement faces real-world challenges in applying traditional legal frameworks to digital theft. That means even if a thief is caught, the stolen crypto may be difficult or impossible to recover.

While some cases end with suspects arrested, such as the James Island home invasion, recovering stolen assets — especially cryptocurrency — remains a complex challenge.

Broader Implications for the Crypto Community

Reading about the Mission Dolores heist, I can’t help but think about what this means for all of us in the crypto space. Physical attacks like this are becoming part of the threat landscape, not just online hacks or exchange breaches. If you hold crypto, it’s no longer enough to secure your passwords — your home and devices are now part of your security perimeter.

This trend might change how people behave. Investors could start relying more on institutional custody or professional vault services for large holdings, rather than keeping everything at home. It also raises questions about insurance and personal security services tailored specifically for crypto holders.

What’s more, this isn’t just a San Francisco problem. Anywhere high-net-worth individuals store crypto could become a target. The takeaway? You need an integrated security approach — combining digital, physical, and behavioural safeguards.

Why this matters: understanding the bigger picture helps you see that crypto theft isn’t just financial loss; it’s about personal safety and adapting to evolving risks in a rapidly changing environment.

Takeaways and Precautions

Here’s what I want you to remember:

- Physical and digital security are connected. Protecting your devices alone isn’t enough if someone can enter your home.

- Be mindful of what you signal. Flashy displays of wealth can make you a target, so keep your holdings discreet.

- Take actionable steps today. Hardware wallets, cold storage, strong passwords, video doorbells — simple measures can prevent disaster.

- Stay informed. Following trends, expert commentary, and local news can give you an edge in staying safe.

I’ll leave you with this question: If someone knew you had crypto at home, would they know how easy or hard it would be to access it? Think about that for a moment — and take one small step today to make sure your answer is “very hard.”

For more stories on home security and protecting high-value assets, explore our Home Security section for tips and real-life cases.

Disclaimer: This article is for informational purposes only and does not constitute financial or legal advice. Cryptocurrency investments carry inherent risks, and personal security measures should be tailored to your individual situation. Always do your own research and consult professionals when needed.