Falling Interest Rates Could Help Homebuilders Sell More Homes in 2026

I’ve been following the housing market for years, and I have to say, the December numbers from the NAHB caught my eye. Builder confidence stayed low at 39, just a point higher than November. For context, anything below 50 shows builders are worried about the market. So yes, sentiment is still cautious.

But here’s where it gets interesting: sales expectations for the next six months rose to 52. That’s a subtle but meaningful shift, hinting that builders see a potential turnaround in early 2026. The Federal Reserve’s three interest rate cuts since September seem to be giving them some hope, and honestly, it’s hard to ignore that signal.

If you’ve been wondering whether home sales might pick up next year, this is where the story starts. Builders are navigating a tricky mix of high material costs, tariffs, and lingering affordability concerns. At the same time, lower rates could make financing easier both for construction and for buyers.

It’s a delicate balance, and as someone watching closely, I think understanding these nuances will give you a clearer picture of what 2026 might really look like.

How Falling Interest Rates Will Influence Builders and Buyers in 2026?

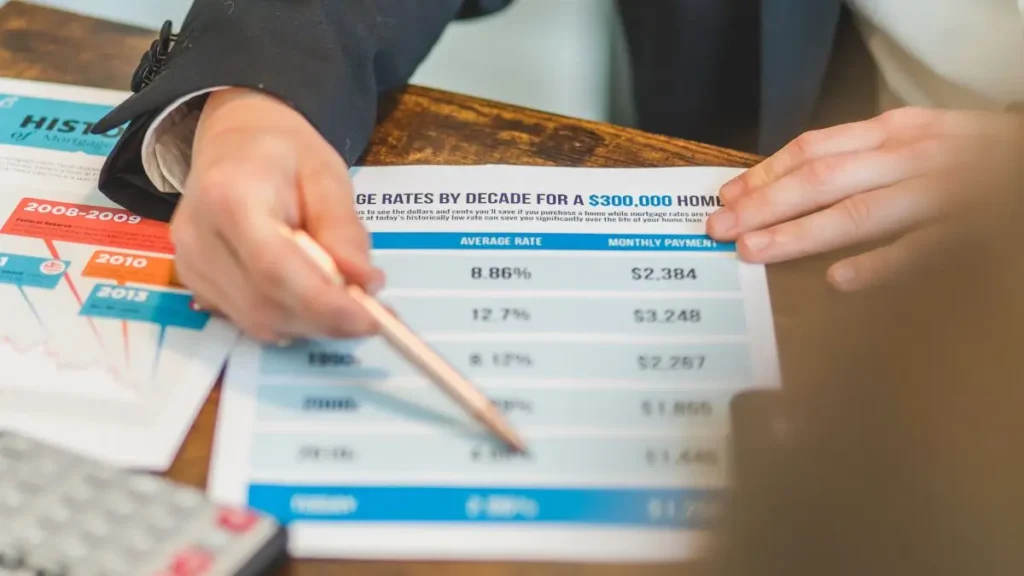

You know, one thing that’s clear from the recent data is how much interest rates matter. The Federal Reserve’s rate cuts since September aren’t just numbers—they’re signals. Builders I’ve spoken to say these cuts could reduce their loan costs for new projects.

And for buyers, lower rates might finally make monthly payments manageable, which is huge for those sitting on the sidelines.

Realtor recently highlighted that easing rates could make 2026 a turning point for home sales. Builders are cautiously optimistic, expecting that some buyers will step in once financing becomes less of a hurdle. But it’s not just rates—the market is still shaped by material costs, labor shortages, and inventory levels. So while lower rates help, they’re part of a bigger picture you need to watch.

Practical takeaway: If you’re thinking about buying, now’s the time to start watching mortgage trends. A small shift could make a noticeable difference in what you can afford.

Builder Strategies Amid Challenging Conditions

Here’s where the story gets real. Builders aren’t just waiting for rates to drop—they’re adjusting. In December, 40% reported cutting prices. That’s the second month in a row hitting this level, something we haven’t seen since May 2020. On top of that, 67% offered incentives like mortgage rate buy-downs—the highest in over five years.

These strategies aren’t random. Builders need to attract buyers who are hesitant due to affordability or uncertainty. I find it interesting that incentives have become such a key part of the market—it shows how tight conditions are. For a buyer, this can be an opportunity. For a seller, it’s a signal that competition for buyers is real and ongoing.

With 40% of builders cutting prices and 67% offering incentives, buyers are gaining more negotiating power, similar to what we observed when home listings surged earlier.

Pro tip: If you’re in the market, look closely at incentives—they’re not just marketing fluff, they’re real savings.

Home Sales Forecast for Early 2026 — Numbers & Expectations

So, what do the numbers say? Builders’ sales expectations index of 52 suggests a modest uptick in early 2026. It’s not a dramatic jump, but it’s significant given the market’s cautious mood.

What’s missing in most coverage is the regional story. Some high-inventory markets may see faster gains, while expensive or low-inventory areas might lag. Price growth is expected to remain moderate because builders are balancing material costs and competition.

Understanding these regional differences is key if you want to make informed buying or selling decisions.

Many buyers are planning ahead—our previous analysis shows that nearly 90% of potential homeowners are aiming to make a purchase in 2026, which aligns with the modest sales uptick builders are expecting.

Practical takeaway: Don’t just look at national trends—check your local market. Where you live will matter more than the overall index.

Buyer Behavior and Market Psychology

Even with slightly better sales expectations, buyers aren’t rushing in. Two-thirds of builders are offering incentives, and many potential buyers remain on the fence. Affordability concerns, economic uncertainty, and delayed government data all contribute to this hesitancy.

I always tell people: understanding the psychology behind buyers is as important as the hard numbers.

The fact that builders need to offer incentives shows that confidence isn’t fully restored. For someone planning a purchase, this knowledge is valuable—you can negotiate from a position of insight rather than assumption.

If you want to stay updated with real-time insights on buyer behavior and market trends, we also share quick tips and alerts via WhatsApp.

Quick insight: Watch for buyer hesitation signals in your area; they can reveal the best time to act.

Regional Spotlights — Where Sales May Actually Pick Up

Finally, let’s talk geography. The national narrative is useful, but the action is local. Southern and Western metros with more inventory could see faster sales improvements. Meanwhile, some high-cost markets in the Northeast and Midwest might remain sluggish.

Realtor notes that even small regional shifts in interest rates or builder incentives can create noticeable differences in activity. So if you’re considering buying or investing, it’s worth zooming in on these hotspots.

Just like homeowners in Boston are bracing for higher property taxes, regional variations will influence where sales pick up fastest and where buyers need to be more cautious.

Pro tip: Keep an eye on local builder announcements and incentives—they often signal where the market is warming up first.

Practical Takeaways for Buyers, Sellers, and Investors

After following the numbers and builder sentiment closely, here’s what I’ve learned—and what I’d advise if you’re thinking about the housing market in 2026.

For Buyers

If you’ve been waiting for rates to drop, 2026 could finally be your moment. Keep an eye on mortgage trends and builder incentives—like price cuts or rate buy-downs—because they can make a real difference in what you can afford.

Don’t wait for the “perfect” time; the early months of the year often offer opportunities before demand picks up fully.

For Sellers

Understand that buyers have options, and builders are actively trying to attract them. If your home is in a competitive area, small concessions or timing your sale with local market trends can make a difference.

Pay attention to local inventory and builder activity; it’s a signal of how motivated buyers really are.

For Investors and Builders

Lower rates help, but supply-side challenges remain. If you’re planning new projects, factor in material and labor costs, and use incentives strategically.

The early months of 2026 could reward well-prepared builders who read both the numbers and the psychology of the market.

The market is cautiously optimistic, but there’s no one-size-fits-all answer. Regional differences, incentives, and buyer sentiment all matter.

I’m curious—if you’re planning to buy, sell, or invest in 2026, what’s your biggest concern right now: rates, prices, or inventory? Drop a comment or share your thoughts—I’d love to hear your perspective and continue this conversation.

For more in-depth coverage on the 2026 housing market, including tips for buyers and sellers, check out our Real Estate & Homeownership section.

Disclaimer: The information in this article is for general informational purposes only and is based on current market data and expert insights. It does not constitute financial, investment, or legal advice. Always consult a qualified professional before making any housing or investment decisions.