10 Affordable States Where You Can Buy a Home—and Still Have a Life

People typically think of run-down communities, long winters, or locations with little going on when they hear the word “affordable.” I understand—I used to think the same thing. But after looking at real figures, local information, and tales from people who live there, I’ve determined that there are states where you can buy a house and live a good life. Not a life of survival, but a good one.

The problem is that most lists simply show the median home price. That’s helpful, but it’s not enough. Is it really worth it to buy an inexpensive property if you detest the weather, can’t find a job, or have to commute 45 minutes to get groceries? Being able to afford something without being able to live in it is just another trap.

That’s why I’m not just giving you a list of affordable states in this essay. I’m showing you where people are really happy when they buy. It’s a place where you can settle down, build your profession, enjoy the weekends, and still pay your mortgage without giving the bank your soul.

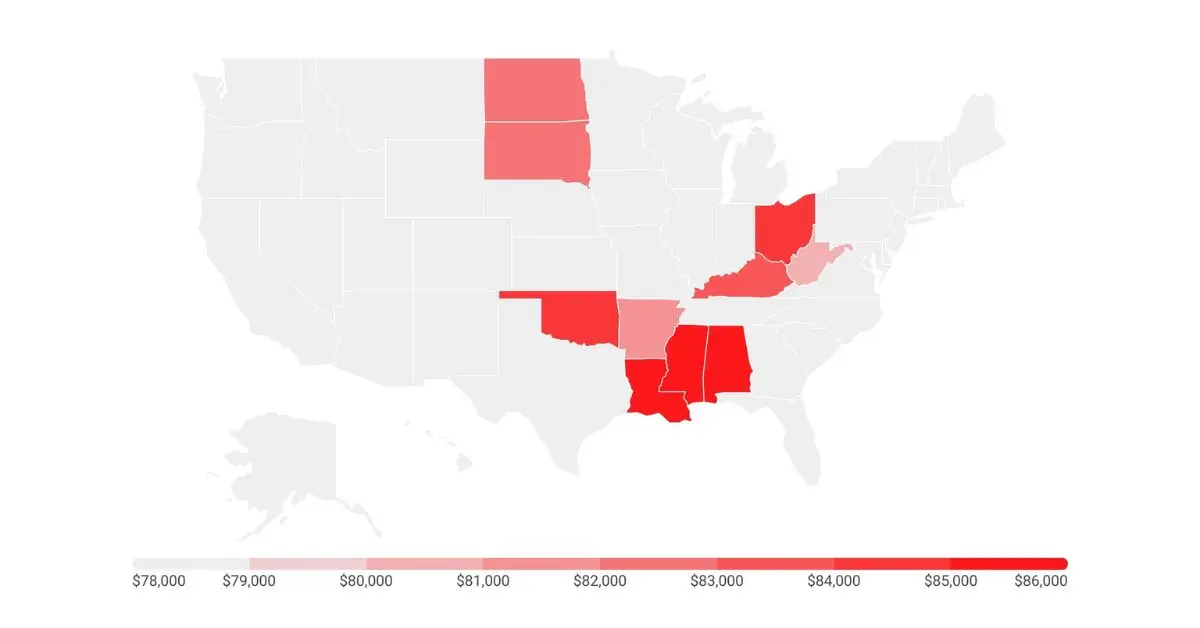

Just a quick fact: the median home price in California is almost eight times the median income. It’s closer to 2.5 times in places like Ohio or West Virginia (source). That’s a big difference, and it makes a big difference when you’re on a budget.

If you can’t afford to live in your present city or are just weary of feeling stuck, keep reading. You might be surprised by where you could live next.

Is it more vital to have a better lifestyle or a cheaper cost of living? Or are you looking for both? Please leave a remark and let me know.

How We Chose the Top 10

I didn’t just choose states at random from a map or copy what other publications said. To be honest, a lot of those lists seem lazy to me because they just put median home prices on a page with no context. That doesn’t help you figure out where to live.

This is what I looked at instead:

- Affordability means more than simply the price of the home; it also means how it compares to the typical income in that state. Is it possible for one person to buy there?

- Cost of living (COL): food, utilities, and health care. If everything else around it costs a lot, a $150,000 house isn’t “cheap.”

- Job market and income potential—what’s the sense of moving somewhere you can’t find job or get ahead?

- Quality of life means things like the weather, safety, commuting times, proximity to nature, and a fast internet connection. Things that have an effect on your daily life.

- Taxes, especially property taxes. They are very different from state to state and can easily ruin your monthly budget.

- Long-term stability: Is the area getting bigger or smaller? Are folks moving in or wanting to get out?

I also read a lot of Reddit threads, professional opinions on Twitter, and personal experiences from people who bought their first home alone. Not just numbers, but real people.

For example, WalletHub’s most recent analysis says that Iowa, Utah, and Indiana all have good scores for both affordability and liveability. That’s the kind of balance I wanted.

And just to be clear, this is not a list of the “cheapest states.” It’s a list of the finest places to live a good life without going broke.

At the end of the day, buying a home isn’t just about how much you can afford; it’s also about what you won’t regret.

10 States Where You Can Afford a Home and Actually Enjoy Living There

1. Ohio: Cheap, Friendly, and Surprisingly Diverse

- The average price of a property is about $205,000.

- Cost of living: 10% less than the national average

- Taxes on property: a little higher than usual, but not too bad

- Vibe: Midwest warmth, good access to healthcare, and food scenes that don’t get enough credit

A number of users on Reddit have said that they can buy homes here on their own. One guy bought a house outside of Dayton for less than $100,000 and still had money left over to travel. That’s true freedom. If you don’t work from home, Columbus and Cincinnati also have burgeoning tech scenes and good career opportunities.

2. West Virginia: Cheap and full of nature

- The average price of a property is about $160,000.

- Cost of living is 14% lower than the national average.

- Vibe: Calm, green, and great for living in peace

This is the place for you if you like land, trees, and space to breathe. It’s not for everyone (it’s rural and slower-paced), but if you work from home or are tired of city life, West Virginia might feel like liberation.

Bonus tip: In many areas in West Virginia, you can get USDA rural loans with no money down. That’s a major gain for people who are buying their first home.

3. Indiana: Reliable, Stable, and Affordable

- The average price of a property is about $225,000.

- Cost of living: 9% less than the national average

- Taxes: There are no state-level estate taxes and property taxes are low.

- Vibe: The job market is steady, notably in healthcare, logistics, and tech areas like Indianapolis.

I like that Indiana doesn’t try to be fancy. But it works. You can find reasonable housing, good public schools in many counties, and a pace of life that isn’t too fast. It’s a good idea for families or people who wish to buy a home on their own.

4. Utah—Surprisingly Cheap for People Who Like the Outdoors

- Average property price: about $385,000 (more than others, but better value)

- Cost of living: About the same as the national average

- High income, job development, proximity to the outdoors, and energy-efficient housing options make up for the cost.

- Vibe: Young, active, and good for families

You could be surprised by Utah. Yes, costs have gone up, but it has something rare: a blend of beautiful nature, clean cities, and high earnings, especially in innovation and healthcare. Utah lets you live the life you choose without paying Bay Area prices. You can walk before breakfast or ski on the weekends.

5. Iowa: The Hidden Gem with a Big Heart

- The average price of a home is about $210,000.

- Cost of living is 12% lower than the national average.

- Vibe: Safe, clean, and stable for true middle-class people that live there.

People don’t talk about Iowa often, but they should. You can purchase a great house in this state on an average income, send your kids to good public schools, and yet have money left over to live. Des Moines is growing quickly, and there are jobs in banking, insurance, and tech that can be done from home.

6. Tennessee: Low Taxes, Big Value

- The median price of a property is about $295,000.

- Cost of living: A little less than the national average

- Taxes: There is no state income tax, and property taxes are lower than normal.

- Vibe: Music, mountains, and movement, especially in areas like Chattanooga and Knoxville.

Tennessee strikes the right mix between cost and lifestyle. There is no state income tax, which means you have more money in your pay cheque. And if you work from home, cities like Chattanooga have amazing internet and a coworking culture, but they don’t have Nashville’s high prices.

Bonus hook: Where else can you live close to the Smokies and hear great live music every weekend?

7. Mississippi: The homes are the cheapest in the U.S., but there’s a catch.

- The average price of a property is about $160,000, which is the lowest in the country.

- Cost of living: 15 to 17 percent less than the national average

- Taxes: Low income tax and a little property tax

- Vibe: Small towns have a strong sense of community, a warm climate, and a slow pace.

Buying a property in Mississippi is always the cheapest state. It’s hard to top for someone who wants to lower their financial stress. That being said, it’s not for everyone. Access to healthcare, job opportunities, and schools might be very different from one area to the next. But if you’re retired, work from home, or are self-employed, it might give you the space you need.

8. Oklahoma: A Great Deal in the Middle of America

- The average price of a property is about $200,000.

- Cost of living is 13% lower than the national average.

- Vibe: Useful, good for families, and with strong community values

Oklahoma is a great place to buy a home if you don’t want to live pay cheque to pay cheque. Cities like Tulsa and Oklahoma City are getting bigger. They have a blend of city growth and small-town friendliness. Property taxes don’t take up too much of your budget, and utilities and food are cheap.

9. Georgia—affordable living with easy access to cities

- The median price of a home is about $300,000 (it’s lower in rural areas and small cities).

- Cost of living: Close to the national average

- Taxes: Not too high or too low

- Vibe: Lots of culture, moderate winters, nice food, and lots of green

People don’t generally think of Georgia as a cheap place to live because costs are going up in Atlanta. But if you go outside of the metro area, the value becomes evident, especially in locations like Macon, Augusta, or even suburbs with MARTA access. This is a serious competitor for purchasers who desire moderate weather, Southern charm, and easy access to city jobs.

10. Texas: A Big State with Lots of Options (If You’re Smart About It)

- The median price of a home is about $315,000, but this varies a lot from city to city.

- Cost of living: In many areas, it’s lower than the national average.

- Taxes: There is no income tax, but property taxes are substantial.

- Vibe: diverse, business-minded, and rising quickly

Texas isn’t as inexpensive as it used to be, but there are still a lot of chances there if you stay away from the big cities. Instead of Austin and Dallas, look to cities like Lubbock, Temple, or even sections of San Antonio. The job market is good, there are a lot of houses for sale, and for many single buyers or young families, it’s still a good spot to settle down.

What Other Lists Miss (And Why It Matters)

The same basic formula is used over and over again in most “best states to buy a home” lists: median home price, cost of living, done. But if you’ve ever really looked for a place to live, not simply a place to buy, you know how incomplete that is.

Here are some things that those lists normally don’t tell you:

1. They don’t think about why homes are affordable.

A $160,000 house could sound amazing, but then you find out that it’s inexpensive because there aren’t many employment, hospitals are far away, or the area is losing people. Just because something is cheap doesn’t mean it’s good.

That’s why this report lists job growth, liveability, and long-term prospects for each state. I didn’t simply look for “cheap” accommodations; I also looked for locations you’d genuinely want to stay.

2. They don’t talk about how taxes and money problems will affect you.

Property taxes, insurance costs (particularly in areas prone to hurricanes or wildfires), and HOA fees may all add up quickly and make a “cheap” house very expensive. Texas, for instance, doesn’t have an income tax, but its property taxes are among the highest in the country. That means something.

Other guides don’t go into this. I didn’t. Every state here has that layer, so you won’t be surprised later.

3. No real-world context

I couldn’t stop seeing the stories on Reddit threads and Facebook groups. People buy their first home by themselves and make it work in regions like Indiana, Ohio, or Tennessee on $40,000 to $60,000 a year.

That human angle is what you really need, yet most lists don’t have it. These aren’t just numbers; they’re things that people have gone through.

4. They miss remote work as a game-changer.

Things have changed since 2020. If you can work from anyplace, you don’t have to live in a city with high rents. But very few publications about affordability even bring this up.

You can unlock lifestyle wins that most people don’t even think about if you work from home. Fibre internet in small towns. Peaceful neighbourhoods where you can get things done. Commutes that start at your kitchen table and end quickly.

5. They forget how to live emotionally

No one wants to buy a house and feel stuck. You want to feel at home, safe, happy, and like you belong. These places on our list are not only cheap, but they are also livable. That’s a big difference.

A $200,000 house is only a fantastic deal if everything else in your life works well too. That’s what most lists don’t include, but I didn’t want to overlook it.

Quick question: Have you ever looked at a list of “cheap states” and thought something was wrong? What did they forget to do for you? Leave a remark; I’d love to know what you think.

How to Choose the Right State for You

The truth is that just because all 10 states on this list are “affordable” doesn’t mean they are all good for you. It’s not a maths problem to buy a house; it’s a choice you make in life. That implies you need to do more than just match your budget.

Let’s split it down into useful filters. These will help you decide which state is best for your life, your ambitions, and your daily needs.

1. Are you remote or bound to a local job?

If you’re remote, you’re in a better position. You can put lifestyle, climate, and quality of life at the top of your list. That makes states like West Virginia, Mississippi, and Tennessee more accessible. There may not be a lot of jobs there, but living is excellent and costs are low.

But what if you need a job market in your area? If that’s the case, Indiana, Georgia, or Texas (outside of cities) might be preferable for you. These states offer steady jobs, healthcare systems, and sectors that are rising.

2. What kind of weather do you like?

- Do you hate snow? Don’t go to Iowa or Ohio.

- Want seasons? You might want to stay away from Texas or Mississippi.

- Do you love being outside? Utah has great nature and solid homes.

Buying a house is a big decision that will affect you for a long time. You don’t want to dread half the year.

3. Are you single, in a relationship, or raising a family?

People who buy things alone can like smaller communities that have access to culture, safety, and walkability, like Tulsa, OK or Chattanooga, TN.

Families? Look for a place with low crime, decent schools, and good health care. That’s where Indiana, Iowa, and Utah really excel.

4. Is the price of the item less important to you than the taxes?

Some individuals just care about the price of a house, yet tax policy is what makes a house affordable in the long run. Texas and Tennessee (which don’t have an income tax) would be better than places with hidden charges like hefty property taxes or car fees if you want to make your money go further.

Just keep in mind that low income tax often means giving up something. Always find out what programs aren’t funded in your area.

5. Do you have some things about your lifestyle that you won’t change?

Think about:

- Getting to airports or public transportation

- Being close to family

- The political climate or the values of the community

- Food, arts, and local culture

- Access to health care

These aren’t “soft” factors; they’re what makes a place feel like home.

Use this guidance as a starting point, but make sure it fits with your life. It’s excellent that there isn’t a one-size-fits-all state.

Now tell me: What’s the most important thing to you when choosing where to live? Is it the price, the weather, the job market, or something else? Leave your thoughts below.

Smart Moves Before You Buy

Let’s assume you’ve picked a state, discovered a few properties that fit your budget, and you’re getting enthusiastic. Before you sign anything, it’s a good idea to take a step back and think about your plan. Just because you buy a house in a state where homes are cheap doesn’t indicate you’ll be successful.

This is what smart purchasers do initially.

1. Look for USDA, FHA, or first-time buyer programs

You might be able to get a USDA loan with no down payment, low interest rates, and liberal credit standards in a lot of rural and semi-rural locations, like parts of Ohio, West Virginia, and Mississippi. It’s one of the instruments that people don’t utilise very often.

FHA loans and municipal first-time buyer grants can also make a big impact in cities. Some states will even help you with closing costs or provide you tax benefits.

Check your eligibility at here for a pro tip.

2. Do a full-cost ownership analysis, not just the mortgage.

Don’t only look at your monthly mortgage payment. Think about:

- Taxes on property (Texas and New Jersey have substantially higher rates than most places)

- Insurance (particularly in locations that are prone to hurricanes or floods)

- HOA fees (some rural neighbourhoods now have these)

- Utilities (it may cost more to heat or cool in rural locations)

For example, the mortgage payment of $950 per month might go up to $1,400 with taxes, fees, and insurance. Always think about the total cost.

3. Talk to someone who already lives there.

Nothing beats knowing what’s going on in your area. Get on Reddit, Facebook groups, or even Nextdoor. Not just the wonderful things, but also what people complain about, ask what it’s like to live there.

4. Make plans for 3 to 5 years, not simply 1.

Are you buying a house or just getting away from your current environment for a little while? Think about this:

- Will I still like this place in five years?

- Will my job or money still work here?

- If I had to, could I sell or rent this house?

This kind of thinking helps you avoid making mistakes that cost you money.

The best buyers don’t only buy things that are cheap. They learn how things work, ask tough questions, and plan for the long term.

Before you even start browsing listings, make sure you know what you’re signing. A lot of first-time buyers skip the paperwork part—which can cost you big. Here’s a guide on the essential home-buying documents you should always (and never) sign before closing any deal.

What is the one issue that still makes it hard for you to buy a home in a new state? Put it in the comments, and I’ll do my best to help or add your question to this section.

Beyond Buying: Thriving in Your New State

The first step is to buy the house. What comes next is what actually matters, and no mortgage calculator can show you that. The everyday beat. The feeling of the weekend. If the place you buy feels like a place you belong.

This part is about more than just having a home; it’s about constructing a life.

You desire more than just a roof over your head.

Let’s be honest. No one wants to live in a cheap house in a boring, secluded town and barely get by. The goal isn’t just to be able to afford it; it’s to have a complete, stable, and liveable life. That includes:

- A feeling of safety

- Green space or being able to walk

- A community that shares your beliefs

- A stable job or a way to move up in your career

Being able to afford little pleasures like going out to eat, going on weekend excursions, and having hobbies

You don’t need to be rich. You need a life that feels like yours, though, not one where you have to give up something all the time.

What it looks like to be successful (real-life examples)

- A person who works from home in Iowa rides their bike to a coffee shop every morning, logs off at 4, and gets to their kid’s soccer game.

- A couple in Indiana who went from renting in Chicago to owning a three-bedroom house with a yard, which means they can finally get a dog.

- A young teacher in Tennessee who now saves 20% of her salary instead of paying 60% of it in rent.

This is what makes life worth living. And it’s what too many lists of affordable things leave out.

Things to look into outside housing

If you really want to put down roots, don’t just look at Zillow. Ask:

- How far away is the nearest hospital?

- Not just the city, but the zip code as well.

- Are there any parks, libraries, gyms, or places to work together nearby?

- Do I really have to drive 30 minutes simply to buy food?

- Is there a sense of community, or is everyone just passing through?

These are the things that make you happy every day. Not the interest rate on the mortgage.

What’s the point? The finest property to buy is one that fits with the life you wish to live. Not just what you can afford on paper, but what feels right in real life, day after day and season after season.

Tell me, what does it mean for you to be “thriving”? Weekends that are quiet? Schools that are better? Do you want to spend more time with your family? Your answer could inform you exactly what to do next.

If you’re still in school or recently graduated, don’t assume homeownership is out of reach. This honest breakdown covers the things no one tells you about buying a home as a student—credit myths, cosigner realities, and loan tips that actually work.

Final Take: Build a Life You Don’t Need to Escape From

People don’t merely hunt for “affordable states” to save money. There is more to it than that. You’re sick of the stress of money. You need room. Stability. A future that doesn’t seem to be slipping away all the time.

You can definitely get there by buying a house in the correct state, but only if you know what you’re getting into. Buying the cheapest dwelling isn’t always the best choice. There are often hidden charges in the “hot” cities. And a lot of people forget that when you buy a house, you’re also buying into a way of life.

This is what I hope you remember:

- You can buy a house even if you don’t make a lot of money.

- There are areas where you can genuinely live well, not merely get by.

- Not simply national rankings, but also what you care about will help you choose the ideal state.

- The best thing to do is to do what helps you be who you are and who you want to be.

There are great chances waiting for you if you can look past trends and think about what really important, such income vs. cost, neighbourhood, and quality of life. Perhaps in a spot you never thought of.

Stop trying to get status and start making something real.

The housing market looks different in 2025—rates, programs, and buyer behavior have shifted fast. Here’s what’s changed in home buying for 2025 that you should know before making any move.

What are you going to do next? Are you just doing research, or are you ready to start looking? Leave a remark; I’d love to know what’s on your mind right now.

Looking to buy smart and live better?

Explore more guides and tools at Build Like New — where affordability meets real-life living.

Disclaimer This article is for informational purposes only and should not be taken as financial, legal, or real estate advice. Housing prices, taxes, and cost-of-living data may vary by city, zip code, or year. Always consult with a licensed real estate agent, mortgage advisor, or local financial expert before making home-buying decisions.