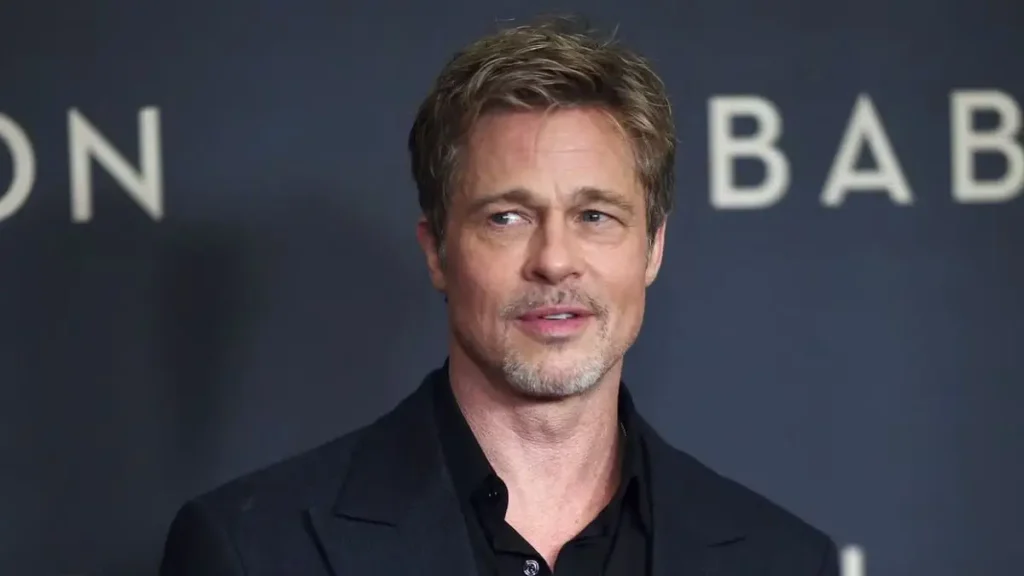

Brad Pitt’s $117 Million Property Portfolio: A Peek Inside His Real Estate Investments

You probably know Brad Pitt as a Hollywood icon, but what you might not realize is just how strategic he’s been off-screen—especially when it comes to real estate. This isn’t just a celebrity buying random mansions. This is a guy who’s built a $117 million property empire over nearly three decades, brick by brick, house by house.

It all started quietly in the mid-90s with a single Craftsman-style home in Los Feliz. Nothing flashy. Just a smart, tucked-away purchase in a solid L.A. neighborhood. But that one house? It turned into a multi-lot compound with its own skate park, tennis pavilion, and even a rumored secret tunnel. Yeah, really.

What stands out to me here isn’t just the scale—it’s the vision. While most celebs flex with flashy penthouses, Pitt built something thoughtful, layered, and personal. He kept buying up neighboring lots over years, not for show, but to shape a space that actually meant something to him. And when he sold it in 2023 for a reported $33 million? That was after living there for nearly 30 years. That’s not just an investment. That’s legacy.

I think this part of his story matters because it shows that building real estate wealth doesn’t have to be instant or impulsive. Sometimes, it’s about playing the long game—owning well, holding smart, and building something with purpose.

The Los Feliz Swap — A Boutique Downgrade with Heart

When Brad Pitt sold his Los Feliz compound in 2023, it felt like the end of an era. Nearly 30 years earlier, he bought the original house for just $1.7 million, then quietly expanded the property over time—adding surrounding lots, a skate park, and even stories of secret tunnels. It was personal, not performative.

But here’s what caught my attention: he didn’t just cash out and disappear. According to Hello Magazine, Brad swapped the massive compound for a sleek $5.5 million mid-century home just minutes away. It belonged to oil heiress Aileen Getty. Smaller footprint, but high on style.

To me, this move says a lot about where his priorities are now—less about scale, more about intention. And honestly? That’s a shift worth watching.

The Malibu Flip — Timing Meets Taste

Back in 2005, Brad bought a modernist beach house in Malibu for around $8.4 million. It wasn’t huge, but it had that clean, mid-century vibe: sharp lines, ocean views, open plan living. He didn’t just live in it—he refined it.

When Ellen DeGeneres bought it for $12 million a few years later, it was clear the upgrades paid off. And then she flipped it again for $13 million. Not bad returns for a quiet coastal spot.

What stands out to me here isn’t just the profit—it’s the patience. He didn’t rush the sale. He invested in good design and let the value build. That kind of long-game thinking is what separates casual buyers from real estate players.

It’s a similar design-first legacy play like what we saw in Hugh Jackman’s New York brownstone investments—where taste shapes every square foot.

The Goleta Beach House — Serenity on the Coast

Not every Pitt property is a headline-stealer. In 2000, he bought a low-key beach house in Goleta, just up the coast from Santa Barbara. Price tag? Around $4 million.

According to Robb Report, this one was all about peace. Tucked away from paparazzi and Hollywood drama, it became a kind of personal sanctuary. Nothing overbuilt, nothing flashy—just clean views, sea air, and space to unplug.

It reminds me that smart real estate isn’t always about ROI. Sometimes, it’s about lifestyle return. And that counts for a lot more than people think.

That low-key beach energy actually reminds me of Ben Affleck’s Malibu investment strategy—another example of how some actors go for peaceful, high-value coastal zones over flashy L.A. spots.

The Carmel Highlands Jewel — Craftsmanship Meets Clifftop Calm

One of Pitt’s boldest purchases came in 2022 when he dropped $40 million on a historic estate in Carmel. It’s called the D.L. James House, and it’s a piece of architectural art—built into the cliffside with native sandstone, curved archways, and intricate woodwork.

It’s the kind of place you don’t just buy—you preserve. Originally designed by Charles Greene (of Greene & Greene), the house isn’t just rare, it’s revered. Pitt’s known for his obsession with architecture, and this move? It cemented that legacy.

I look at this property as a statement. Not of wealth—but of taste, values, and reverence for design that lasts beyond lifetimes.

Honestly, with the way so many A-list celebrities are quietly building real estate portfolios behind the scenes, it’s become a bit of a game on social media. If you’re curious about where your favorite stars are investing—or thinking about doing the same—there are some great threads floating around on X, Facebook, and even a few tight-knit WhatsApp groups that track these moves in real time.

The Château Miraval Story — Wine, Music, and Legacy

Let’s talk about Château Miraval—the French estate Brad bought with Angelina Jolie in 2011. You’ve probably seen it splashed across tabloids because of the rosé and the legal drama. But underneath that noise is a seriously smart investment.

It’s 1,200 acres in Provence. There’s a 35-room mansion, olive groves, and an award-winning vineyard. But what most people miss? The recording studio. Pink Floyd recorded here. So did Sade. In 2021, Pitt restored it with producer Damien Quintard to turn it into a modern creative hub.

This isn’t just real estate—it’s income, influence, and legacy wrapped into one. Even with the ownership battle still ongoing, Miraval has already become something bigger than a home. It’s a brand.

Pitt’s vision for Miraval feels similar to how Kylie Jenner turned her real estate into a lifestyle extension—a brand move more than just bricks and land.

What’s Next? Where Pitt Might Be Headed

Lately, it feels like Brad Pitt is rewriting his own rulebook. After decades of expanding and building, he’s started trimming things down—not just physically, but philosophically. And honestly, I think there’s something we can all take away from that.

When he sold his massive Los Feliz compound and moved into a mid-century modern home, it wasn’t a downgrade—it was a design-first decision. Smaller, yes. But smarter. This wasn’t about impressing anyone. It was about living with intention. You can feel it: he’s shifting from scale to substance.

At the same time, there’s that legal cloud over Château Miraval. After Angelina Jolie sold her share to a third-party (Tenute del Mondo), Brad’s been locked in a legal battle to reclaim full control. How that plays out could define whether Miraval becomes his long-term legacy—or something he steps away from entirely.

And then there’s the wildcard: international expansion. He’s already dipped into Spain with a villa in Mallorca, and there are whispers about other overseas interests. Given his love for architecture, I wouldn’t be surprised if he leans more into heritage properties—restoration projects that aren’t just valuable but meaningful.

For me, it all signals a new phase. Not empire-building for the sake of status, but a refined portfolio driven by design, legacy, and depth. If you’re someone thinking about your own next move—real estate or otherwise—it might be worth asking: what’s your version of downsizing up?

What about you? If you had one shot at investing in a legacy property—would you go coastal, countryside, or something totally different? Drop your thoughts below.

Final Thoughts

Brad Pitt’s property portfolio isn’t just about big numbers or famous zip codes—it’s a reflection of how personal taste, long-term thinking, and creative vision can shape real value. From quiet beach escapes to French vineyards with recording studios, he’s treated real estate like a canvas, not just a balance sheet.

And whether you’re a seasoned investor or just starting out, there’s something here for you too: buy with purpose, hold with patience, and let your spaces tell a story.

Like deep dives into celebrity real estate? Check out more smart breakdowns on luxury property stories on our website.

Disclaimer: All property values, purchase dates, and ownership details are based on publicly available sources and reports. Figures mentioned are approximate and may not reflect current market valuations. This article is for informational purposes only and not intended as financial advice.