GOP Budget Omits Social Security Tax Cuts—Implications for Homeowners Over 65

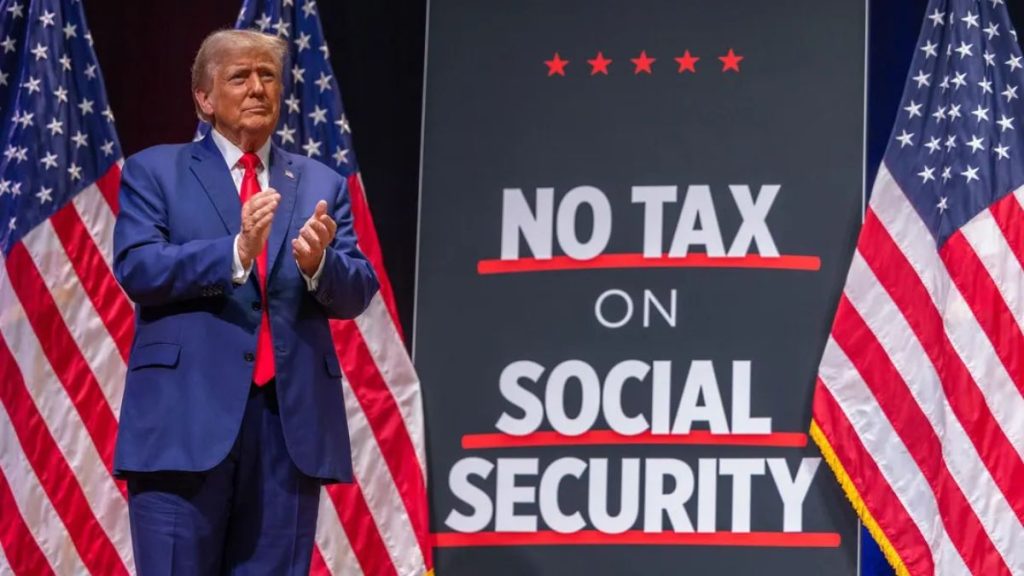

If you’re living on Social Security—or planning to—you’ve probably heard the buzz: the House is pushing a $14.8 trillion tax elimination plan that could put more money back in your pocket. At first glance, it sounds almost too good to be true. A $4,000 “senior bonus” tax deduction? No more taxes on your Social Security checks? It’s the kind of headline that grabs attention—but also raises serious questions.

I’ve spent the past 20+ years writing about policy, money, and how it all hits real people. So when I see a plan this bold, I want to dig into what’s real, what’s missing, and what this could actually mean for you and your future.

Right now, most articles are just echoing the basics—what the bill proposes, what lawmakers are saying—but very few are going deeper. No one’s really breaking down how this would work, who benefits the most, or what risks come with a tax cut this size. And that’s where this article comes in.

We’re going beyond the headline. You deserve to understand not just the “what,” but the “why” and “how”—because if this becomes law, it could change your retirement income in a big way.

So let’s unpack it together—no jargon, no hype—just clear, honest insight.

Decoding the $4,000 “Senior Bonus” Deduction

Let’s start with the part that’s getting the most attention: the so-called “Senior Bonus.” If you’re 65 or older, this proposal would give you a $4,000 extra tax deduction every year. The idea is to reduce how much of your income the IRS can touch—especially if you’re on a fixed income like Social Security.

Now, in plain terms: this doesn’t mean you get $4,000 in cash. It’s not a check. It means your taxable income goes down by $4,000, which could lead to a smaller tax bill—or possibly no tax bill at all, depending on your income level.

And if your Social Security benefits are already being taxed? This could help eliminate that burden for many seniors. That’s a big deal. According to the IRS, around 40% of Social Security recipients currently pay taxes on their benefits. For some retirees, that tax adds up to hundreds or even thousands of dollars a year—money that could’ve gone toward groceries, meds, or bills.

But here’s what most people aren’t talking about:

- This deduction isn’t refundable. So if you don’t owe taxes, it won’t increase your refund or give you extra money—it only helps if you have taxable income to offset.

- It’s unclear how it would interact with other deductions, like the standard deduction for seniors. Would it stack? Replace it? Lawmakers haven’t spelled that out yet—and most articles aren’t even asking.

- Middle-income retirees may benefit more than low-income seniors, who already pay little or no tax. That creates an uneven impact most media hasn’t highlighted.

The bottom line? The $4,000 deduction sounds great—and for many seniors, it could ease the tax squeeze. But we’ve got to keep asking: who actually benefits, and how much will it help the people who need it most?

What would you do with an extra $500–$1,000 a year back in your pocket? For some, that’s survival money. For others, it’s peace of mind. Either way, it’s worth understanding exactly how this plays out.

The Reality Behind Eliminating Taxes on Social Security Benefits

Now let’s talk about the headline promise: no more taxes on Social Security benefits. Sounds amazing, right? Especially if you’re one of the millions of retirees who get hit with that surprise tax bill every spring. But here’s the thing—this idea isn’t new. It’s been floated for decades. And each time, it runs into the same wall: money.

Right now, when your total income (including Social Security, pensions, and savings withdrawals) crosses a certain threshold, up to 85% of your Social Security benefits can be taxed. That threshold hasn’t been adjusted since the 1980s. Meanwhile, costs of living have skyrocketed, and more retirees are crossing into taxable territory—not because they’re rich, but because they’re just trying to stay afloat.

So eliminating these taxes would absolutely give seniors some breathing room. But here’s the catch most articles aren’t telling you: those taxes bring in real revenue—around $47 billion a year, according to the Congressional Budget Office. That money helps fund the Social Security program itself. You cut those taxes, you cut part of the system’s income.

Here’s what needs to be asked (but isn’t, in most media coverage):

- If we eliminate that tax, how do we make up the lost revenue? No one’s giving a clear answer yet.

- Could this move speed up the depletion of the Social Security trust fund? The program is already on track to start cutting benefits by 2034 if nothing changes.

- Is this just a short-term political win with long-term costs?

Let’s be real: giving seniors tax relief is a good goal. But if it comes at the expense of the program’s future stability, that’s a trade-off we need to look at closely. Not emotionally—logically. Because if the system goes under, it won’t matter whether your benefits are taxed… you might not have benefits left to tax.

So before we celebrate, we need clarity. Is this a smart shift or just feel-good policy with risky consequences?

Could This Plan Hurt Social Security Long-Term?

This is the part almost nobody’s talking about—but it might be the most important.

If you’ve been paying into Social Security your whole life, you expect it to be there when you need it. But what happens if the system starts running out of money faster than expected? That’s the big risk behind this tax proposal that’s being overlooked in most coverage.

Right now, the Social Security Trust Fund is projected to run out by 2034, according to the latest Social Security Trustees Report. After that, unless Congress acts, benefits could automatically be cut by about 20% across the board.

That’s already bad enough. But now imagine if the government removes a major source of funding: taxes on benefits. Those taxes bring in billions every year. Cut them, and the math gets worse—a lot worse.

Here’s what the numbers are telling us:

- The Committee for a Responsible Federal Budget estimates that eliminating taxes on benefits would accelerate insolvency by at least a year or more.

- No one in Congress has explained how they’ll make up for the lost revenue. There’s talk of offsetting with spending cuts, but no details.

Let’s be honest: this plan sounds like a gift to seniors now, but if it shortens the lifespan of Social Security, the price down the road could be massive—for you, your kids, and everyone behind you in line.

It’s like patching a leaky roof with duct tape: feels good in the moment, but you’re just buying time while the damage gets worse underneath.

If lawmakers really want to help seniors, they need to show us a full plan—not just the shiny part. Because you and I both know: short-term relief means nothing if long-term survival is at risk.

Winners and Losers: Who Actually Gains from This Plan?

Every time a big tax proposal comes up, there’s one question that matters more than anything: who really benefits? Because the truth is, not every senior will see the same relief from this $14.8 trillion tax plan—and some might see nothing at all.

At first glance, it looks like a win across the board. No more taxes on Social Security, plus a $4,000 bonus deduction? Sounds great. But once you start looking closer, the impact isn’t so equal.

Who the Winners Are?

- Middle-income retirees – If you’re collecting Social Security and also pulling from savings, pensions, or part-time work, you’re more likely to benefit. The deduction could drop you into a lower tax bracket or eliminate your tax bill altogether.

- Married couples with moderate combined income – They often land in that awkward zone where Social Security is partially taxed. This plan could ease that squeeze.

- Seniors still working past 65 – That $4,000 deduction could offset more of their earnings, making work more worthwhile without the tax penalty.

And the Losers

- Low-income seniors – Here’s the truth: many already pay zero taxes on their Social Security. So removing the tax doesn’t help them much—because it wasn’t hitting them in the first place.

- Future retirees – If this plan shortens the lifespan of the Social Security trust fund, the next generation might get smaller checks or delayed retirement ages. That’s a hidden cost most headlines skip.

- Anyone depending on stable federal benefits – If Congress uses spending cuts to pay for these tax breaks, other programs like Medicare, housing assistance, or SNAP could be on the chopping block.

And let’s not forget: tax cuts don’t come with guarantees. If this passes, but inflation rises or benefits shrink down the line, what looks like a win today could hurt tomorrow.

So ask yourself: does this plan help people like you, or just sound good on paper?

What the Experts Are Saying—and Why It Matters

When a plan this massive hits the table—$14.8 trillion in tax cuts—there’s no shortage of opinions. But instead of political spin or emotional takes, let’s focus on what actual economists and policy analysts are saying. Because behind every promise is a ripple effect—and experts are already raising red flags.

Economists Warn of Trade-offs

The Tax Policy Center recently noted that while repealing taxes on Social Security sounds appealing, it would “accelerate the program’s insolvency” unless offset by other funding sources. They’ve crunched the numbers, and without a replacement revenue stream, this move “could drain trust fund reserves earlier than projected.”

Over at the Committee for a Responsible Federal Budget, analysts are calling the plan “fiscally reckless” unless accompanied by clear, detailed offsets. Their concern? That the current proposal is all about short-term political wins, not long-term stability.

Financial Planners Are Cautious

Even financial advisors are urging retirees to “wait before celebrating.” Several quoted in MarketWatch and Forbes point out that many seniors wouldn’t see much change unless they have enough taxable income to benefit from the deduction. For those already below the tax threshold, “this plan may sound better than it is.”

So, What’s the Projection?

Most forecasts suggest the plan would:

- Help some retirees save $500 to $1,000/year, depending on income.

- Add $400–$500 billion in lost federal revenue over the next decade if Social Security taxes are repealed.

- Shorten the Social Security trust fund’s lifespan by 1 to 2 years, possibly more.

That’s not speculation. That’s modeling based on real budget math.

You and I don’t have time for empty promises. We need plans that work—not just politically, but practically. If experts are waving warning signs this early, it’s worth paying attention.

So the real question is: are lawmakers listening? Or are they just writing headlines that sound good in election season?

How the Numbers Stack Up: Now vs. What’s Being Proposed

Let’s cut through the noise and get down to the numbers. Because when it comes to taxes and Social Security, the impact depends entirely on your income situation. One retiree’s “bonus” might be another person’s non-event.

If you’re wondering how this new plan could affect you, here’s a side-by-side look at what seniors pay today vs. what the proposed changes would mean.

Today’s Reality for Seniors

Under current law:

- If you’re a single filer with total income above $25,000, up to 50% of your Social Security is taxable.

- Above $34,000, that jumps to 85% of your benefits.

- For married couples, those thresholds are $32,000 and $44,000.

That means a couple earning $50K between Social Security and other income could be paying taxes on the majority of their benefits—even though they’re not wealthy.

Average tax impact today: Around $1,000–$2,000/year, depending on other income and deductions.

Under the Proposed Plan

The House proposal includes:

- Eliminating all federal taxes on Social Security benefits, no matter your income.

- A $4,000 “Senior Bonus” tax deduction for people 65 and older.

So using the same example—a couple making $50K—their tax bill could drop significantly:

- No tax on Social Security

- $4,000 less taxable income, which could reduce or even eliminate their federal income tax bill

Potential tax savings: $500 to $2,500/year, depending on deductions, filing status, and other income sources.

But… There’s a Catch (or Two)

Most writeups stop there. But here’s what they skip:

- This is just a proposal, not a law. And it may be watered down or blocked entirely in Congress.

- If you’re a low-income retiree already paying no tax, this won’t change your refund or give you extra money.

- The long-term cost to the Social Security system isn’t factored into these rosy calculations.

What’s the Political Reality Behind This Plan?

Let’s be honest: bold tax plans don’t pass on good intentions alone. They survive (or die) in the messy middle of politics—where agendas, elections, and public opinion collide. And right now, this $14.8 trillion proposal is more of a political signal than a done deal.

The bill is backed by House Republicans, many of whom are framing it as a pro-senior, pro-savings measure. They’re pushing the narrative that older Americans deserve tax relief, especially with inflation still biting into fixed incomes.

But here’s what most articles don’t spell out clearly: this plan faces serious headwinds in the Senate, where Democrats control the majority and have already criticized the bill for favoring the middle class and ignoring how it’ll be paid for.

Who’s Backing It?

Conservative lawmakers, especially those aligned with fiscal populism, are fully behind the plan. Many are positioning it as part of a broader “Retirement Rescue” push ahead of the 2024 elections.

Some senior advocacy groups are cautiously optimistic, especially those who’ve long opposed taxation of Social Security.

Newsweek coverage details the proposal and early support from House Republicans.

Who’s Opposing—or Staying Quiet?

- Senate Democrats are calling it an “unfunded promise.” Without a revenue replacement, they say the math doesn’t work.

- Fiscal watchdogs like the CRFB argue it could worsen deficits and harm Social Security’s solvency. Their concern? That tax cuts will be passed without any spending cuts—deepening the national debt.

- The White House hasn’t taken a formal position yet, but insiders suggest they’re not on board unless there’s a clear funding mechanism.

What’s the Outlook?

Realistically, this plan won’t pass as-is. It may be reshaped, trimmed, or used as campaign messaging more than actual legislation. Still, parts of it—like the senior deduction—could be carved out into smaller bills with better chances of moving forward.

So Why Should You Care?

Because even if this version doesn’t pass, it signals where the debate is going. Politicians know retirees are a powerful voting bloc. That means your benefits—and how they’re taxed—are going to stay in the political spotlight.

Bottom line: this isn’t just policy—it’s politics. And like most political moves, the outcome will depend less on what’s right and more on who shows up, speaks up, and votes.

What You Can Do Right Now (Even While Congress Debates)

Let’s be real: most of us don’t have the luxury of waiting around to see what Congress does. Whether this tax plan passes or not, your bills still need to be paid. So while the politicians argue, here’s what you can do today to protect your money—and be ready for whatever happens next.

1. Know Your Current Tax Exposure

Before you worry about potential tax cuts, look at your current tax situation. Are your Social Security benefits being taxed now? If so:

- Check how much of your total income comes from non-Social Security sources (like 401(k), IRA withdrawals, or part-time work).

- Use the IRS worksheet or a tax prep tool to see how much of your benefits are taxable.

If you’re already below the taxable threshold, this new plan won’t change much for you.

2. Talk to a Tax Professional Before Making Changes

This is not the time to assume or guess. If you’re thinking about shifting your income, delaying withdrawals, or adjusting retirement plans based on this proposal—pause.

- These laws haven’t passed yet.

- Your individual tax situation might benefit more from strategies already available (like Roth conversions, charitable distributions, or adjusting withholdings).

A quick conversation with a CPA or financial planner could save you hundreds (or thousands) in the long run.

3. Stay Informed—But Skip the Hype

A lot of headlines are designed to scare or excite you. That’s how media works. But smart decisions come from facts, not fear.

- Stick to trusted sources: IRS.gov, SSA.gov, or reputable news outlets (like the ones we’ve linked earlier).

- Be skeptical of “overnight fixes.” Social Security reform is complex and slow-moving—any change this big will take time.

4. Speak Up if This Matters to You

If you like—or hate—this plan, let your representatives know. Seriously. Most of them don’t hear from regular people. Seniors make up a powerful voting bloc, but too often it’s lobbyists shaping these bills, not you.

Call, email, or show up. Say: “This affects me. Here’s why.” It matters more than you think.

Quick Checklist:

- Know how much tax you currently pay on Social Security

- Don’t make changes based on headlines—wait for real policy

- Schedule a check-in with your financial advisor

- Stay informed through neutral, fact-based sources

- Make your voice heard in your district

Conclusion

This tax plan might look like a lifeline for seniors—and in some ways, it is. Less tax on Social Security, a $4,000 deduction… that kind of relief can feel huge when you’re living on a fixed income.

But it’s not the full picture.

The truth is, cutting taxes without a long-term funding strategy puts the entire Social Security system on shakier ground. That’s not fear-mongering—it’s math. If we want a system that works for everyone, now and in the future, we need more than headlines. We need honest, balanced solutions that protect benefits and make them sustainable.

So don’t just take the promise at face value. Ask the harder questions. Push for clarity. Because your retirement income shouldn’t be a political football—it should be a guarantee.

Disclaimer: This article is for informational purposes only and should not be considered financial, tax, or legal advice. Everyone’s financial situation is different. Always consult with a certified financial planner, tax advisor, or legal professional before making decisions that affect your income or retirement.